“Don’t lose hope there is always a solution”

An interview with Karen Bain, Operations Manager of Ditch Debit with Dignity

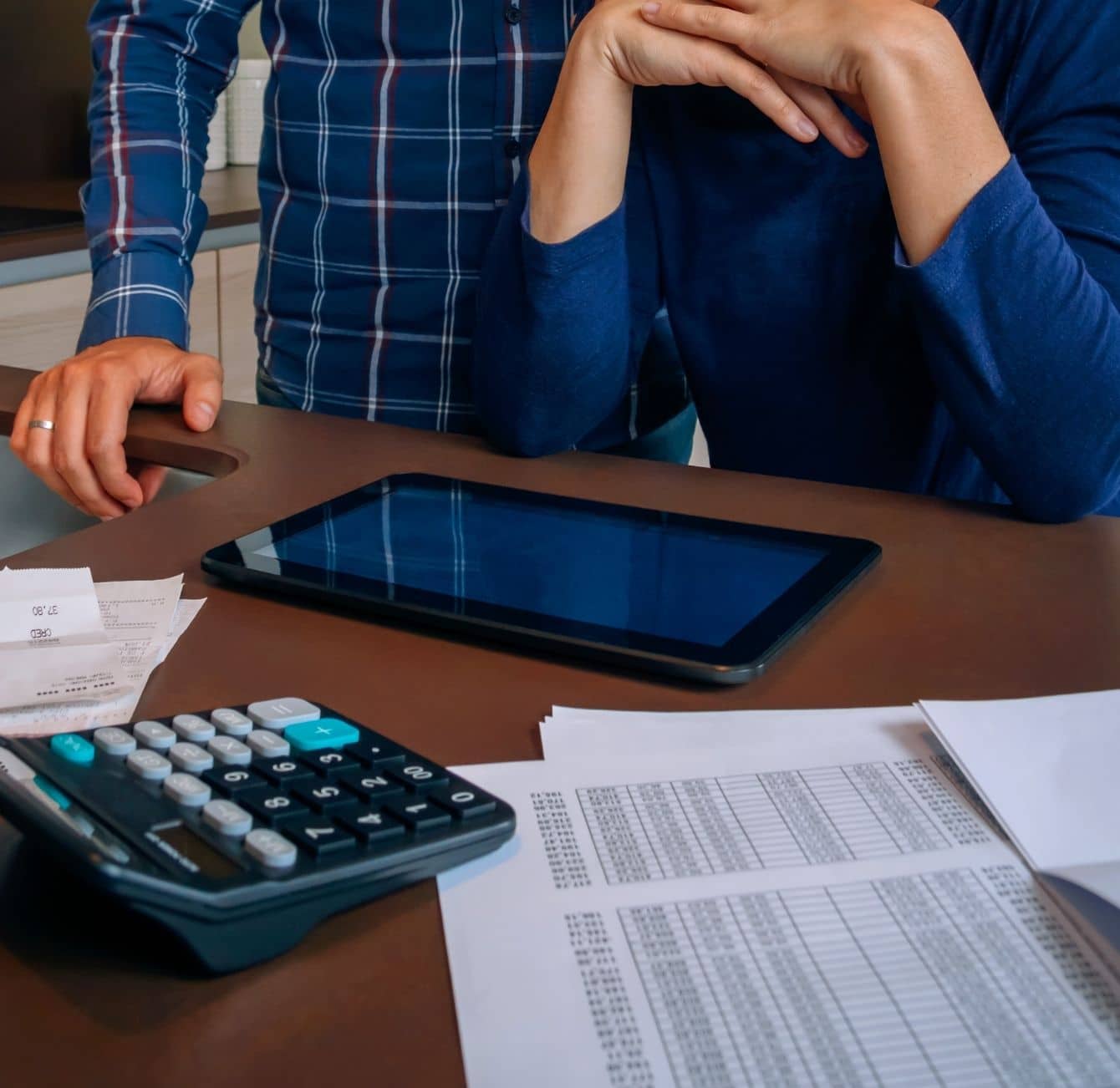

For a number of years, Ditch Debt with Dignity has been offering support and advice to people facing financial difficulties. What was the inspiration behind the formation of the organisation?

In 2009 our founder, Wendy Fleming, woke up one Sunday morning at 5am and wrote down a dream. It was about how true Stewardship comes from using the time, talents, and money that we as individuals have. Using “our gifts” to reach our full potential whilst engaging with and empowering others to reach theirs.

It was from this point Wendy started to explore what she could do using the gifts she had, to help and support others. From 2009-2014 she helped families that would contact her through word of mouth via her “day” job as a Chartered Financial Planner. During those 5 years she began to learn and develop from the people who were in receipt of her support and help, to which she offered freely.

In 2014, after years of building on her knowledge and expertise, she had the nerve and support of two others, who shared her vision, to set up Ditch Debt with Dignity (DDwD) as it is today, supporting people perceived to be financially stable and are privately struggling with their finances.

The reason she wanted to focus on that group of people, who to the outside world seemed to be financially stable, was that in her experience the least

likely to ask for help. People who earn money that preclude them from receiving benefits, often feel like they do not deserve help, should know better, or should be able to get themselves out of the situation. They are also less likely to share the situation with their partners, friends’, or colleagues as most of their peers seem to manage their finances well. Men in these circumstances are more susceptible to self-harm and even suicide.

It is this which has driven the organisation to survive through some really tough times; lack of funding, lack of staff, lack of awareness from people who do not know what it is DDwD is all about.

In the early days there have been many times that Wendy has wanted to give up on the vision, but something her husband Zak, now the Charity Chair, said gave her hope – “surely helping one family is enough reason to keep going”. And it is. If we can stop one person from committing suicide due to the anxiety, stress, and shame of the financial situation they are in, then we must keep going no matter what struggles the organisation faces.

For a number of years, Ditch Debt with Dignity has been offering support and advice to people facing financial difficulties. What was the inspiration behind the formation of the organisation?

In 2009 our founder, Wendy Fleming, woke up one Sunday morning at 5am and wrote down a dream. It was about how true Stewardship comes from using the time, talents, and money that we as individuals have. Using “our gifts” to reach our full potential whilst engaging with and empowering others to reach theirs.

It was from this point Wendy started to explore what she could do using the gifts she had, to help and support others. From 2009-2014 she helped families that would contact her through word of mouth via her “day” job as a Chartered Financial Planner. During those 5 years she began to learn and develop from the people who were in receipt of her support and help, to which she offered freely.

In 2014, after years of building on her knowledge and expertise, she had the nerve and support of two others, who shared her vision, to set up Ditch Debt with Dignity (DDwD) as it is today, supporting people perceived to be financially stable and are privately struggling with their finances.

The reason she wanted to focus on that group of people, who to the outside world seemed to be financially stable, was that in her experience the least likely to ask for help. People who earn money that preclude them from receiving benefits, often feel like they do not deserve help, should know better, or should be able to get themselves out of the situation. They are also less likely to share the situation with their partners, friends’, or colleagues as most of their peers seem to manage their finances well. Men in these circumstances are more susceptible to self-harm and even suicide.

It is this which has driven the organisation to survive through some really tough times; lack of funding, lack of staff, lack of awareness from people who do not know what it is DDwD is all about.

In the early days there have been many times that Wendy has wanted to give up on the vision, but something her husband Zak, now the Charity Chair, said gave her hope – “surely helping one family is enough reason to keep going”. And it is. If we can stop one person from committing suicide due to the anxiety, stress, and shame of the financial situation they are in, then we must keep going no matter what struggles the organisation faces.

What are some of the messages you as an organisation look to convey to people who are affected by debt?

Our vision – A world where people are not ashamed to ask for help when they are in financial crisis, and that there is free guidance available to anyone who needs it.

Our mission – To provide free, non-judgemental, discreet, professional advice and support to people perceived to be financially stable, privately struggling with their finances, empowering them to put a manageable debt repayment plan in place allowing them to have clarity and positive fresh perspective for the future.

Our Values

- Confidentiality – ensuring our clients’ situation is dealt with in strictest confidence and that we adhere fully to the principles of Data Protection.

- Compassion – having sympathetic concern for the wellbeing of others.

- Professionalism – working in a manner that is informed and competent.

- Respect – treating each other with dignity and due regard for each other’s situation, values, and opinions.

- Integrity – being authentic, honest and of good character in all that we do.

Aims – To achieve this mission we aim to;

- act in a caring, encouraging, and non-judgmental manner.

- help prevent or ease the profound consequences of unmanageable debt by providing a professional support network to help alleviate, stress, anxiety, loss, loneliness, addiction, lack of confidence, shame, and relationship breakdown. In severe circumstances this can lead to thoughts of suicide.

- provide a professional, confidential, and safe environment.

- give breathing space from creditors.

- help our clients to implement a manageable debt repayment program, or work through tailored solution specific to their personal situation.

- support clients to rebuild confidence and look towards the future with a more positive frame of mind in which our clients can manage their own finances well.

Our goals

- To never turn away a client that we can support.

- To be fully staffed to meet the need.

- To build a team of colleagues, who are passionate about the organisation and its purpose.

- To have robust, compliance and competent processes and procedures in place which, meet regulatory obligations, and those of our colleagues and clients.

- To Steward our finances ethically and responsibly.

Obviously the pandemic and resulting employment issues has had a major impact on people across the country, have you seen evidence of this through your work at Ditch Debt with Dignity?

Across the third sector, the ability to carry out face to face activities has been somewhat restricted of late and even with restrictions being lifted a return to normal life will not be immediate. Charities like DDwD provide vital services in the community every day, which sometimes goes unseen. Many people will emerge from this crisis with financial difficulties, health concerns and a feeling of disconnect. They will need their communities and charities more than ever. That is a challenge that the sector will undoubtedly work hard to meet, despite the difficult financial circumstances it will be facing.

Where we are already working hard to support vulnerable people in our community, those that are at risk losing their homes, livelihoods and having the threat of bankruptcy. We are keen to be using our skills and knowledge to access a wider range of people in the community, who are desperately in need of our services.

Our team understands that our interaction with clients and the support of families not only deals with debt management but also the personal aspects of an individual’s life and realise the extent to which this can affect their mental health.

As we move into our new normal, we are facing some uncertainty about the future. With furlough ending and organisations will be trying to decide the best course of action to take for business and employees, having already faced a devastating year of unpredictability and risk. Some will most likely decide that the future is too insecure for them and close up shop. Whilst we do not want to be the messengers of doom, we do want to be there for the people who find themselves in that kind of precarious position, not knowing where to turn, feeling isolated and in need of help.

Obviously the pandemic and resulting employment issues has had a major impact on people across the country, have you seen evidence of this through your work at Ditch Debt with Dignity?

Across the third sector, the ability to carry out face to face activities has been somewhat restricted of late and even with restrictions being lifted a return to normal life will not be immediate. Charities like DDwD provide vital services in the community every day, which sometimes goes unseen. Many people will emerge from this crisis with financial difficulties, health concerns and a feeling of disconnect. They will need their communities and charities more than ever. That is a challenge that the sector will undoubtedly work hard to meet, despite the difficult financial circumstances it will be facing.

Where we are already working hard to support vulnerable people in our community, those that are at risk losing their homes, livelihoods and having the threat of bankruptcy. We are keen to be using our skills and knowledge to access a wider range of people in the community, who are desperately in need of our services.

Our team understands that our interaction with clients and the support of families not only deals with debt management but also the personal aspects of an individual’s life and realise the extent to which this can affect their mental health.

As we move into our new normal, we are facing some uncertainty about the future. With furlough ending and organisations will be trying to decide the best course of action to take for business and employees, having already faced a devastating year of unpredictability and risk. Some will most likely decide that the future is too insecure for them and close up shop. Whilst we do not want to be the messengers of doom, we do want to be there for the people who find themselves in that kind of precarious position, not knowing where to turn, feeling isolated and in need of help.

As an organisation you offer help and advice for people facing financial crisis, what kind of services and support do you offer?

Ditch Debt with Dignity (DDwD) is an Aberdeen based charity which supports people in the Aberdeen and Aberdeenshire area.

We provide free, non-judgmental, discreet, professional advice and support to people perceived to be financially stable, privately struggling with their finances, empowering them to have clarity and positive, fresh perspective for the future.

We offer clients a realistic plan in place to repay their debts. In addition, we work with them to understand the issues that led to the debt, enabling them to establish a healthier relationship with money and put in place a more secure financial foundation for the future.

Since 2017 we have worked with over 50 families in the Aberdeen and Aberdeenshire whose debt totalled over £750,000.00. The affordable debt repayment plans we have agreed on our clients’ behalf have resulted in the repayment of more £200,000 of debt.

The DDwD team are fully aware of the impact that debt has on families. We take a holistic approach to work with families to identify what additional support may be necessary. This can include supporting clients to face the personal challenges that have led to their debt problems. We have assisted clients who have a severe propensity for over-spending, people who have become caught in a spiral of gambling addiction and those whose inability to budget has seen a drastic amount of debt from bills accumulating and people who have recently been made redundant and have commitments they cannot now fill.

Clients can have tremendous problems in facing the reality of the impact on the family. The impact of debt can also impact on the client’s professional life as s/he is unable to focus on work and so the spiral continues. We are there to provide a solution as well as a safe space to work through the journey, providing support so that the circle does not continue.

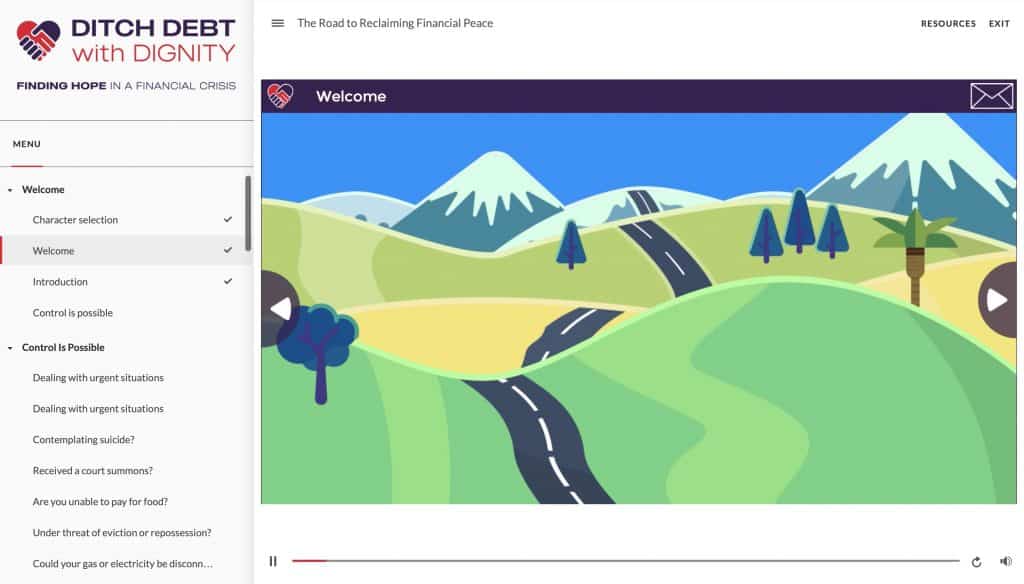

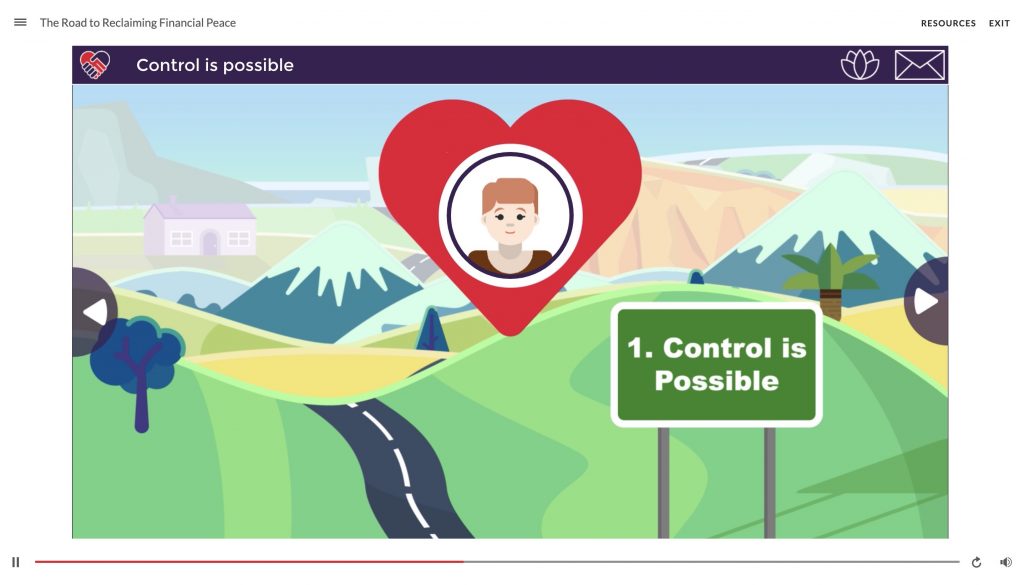

Could you tell us more about your new video resource?

The video resource is for individuals to use, in conjunction with advisers’ support or on their own. These videos go through the entire process of recovering from debt in great detail, they also include many resources to enable individuals to keep track of their progress along each step of the way. These combined assets will give people hope, enabling them to see a light at the end of the tunnel and get them making a difference in their own lives for the better.

It was extremely important to us to be able to host these free videos on our website, giving individuals a range of options and services from our organisation, whilst still offering the 1:1 sessions that we offer at present. The videos have given us the ability to reach a much larger client group than we can with advisers alone as they are not bound to a specific geographical area. That’s the beauty of the video resource, it can be used anywhere, at any time and at a pace that is right for the individual.

While we thrive on client interaction, we realise that debt is a very private matter, and the videos may just give the advice and guidance needed to set you on the path without having any human interaction. Although we are only a click away if additional support is needed.

Could you tell us more about your new video resource?

The video resource is for individuals to use, in conjunction with advisers’ support or on their own. These videos go through the entire process of recovering from debt in great detail, they also include many resources to enable individuals to keep track of their progress along each step of the way. These combined assets will give people hope, enabling them to see a light at the end of the tunnel and get them making a difference in their own lives for the better.

It was extremely important to us to be able to host these free videos on our website, giving individuals a range of options and services from our organisation, whilst still offering the 1:1 sessions that we offer at present. The videos have given us the ability to reach a much larger client group than we can with advisers alone as they are not bound to a specific geographical area. That’s the beauty of the video resource, it can be used anywhere, at any time and at a pace that is right for the individual.

While we thrive on client interaction, we realise that debt is a very private matter, and the videos may just give the advice and guidance needed to set you on the path without having any human interaction. Although we are only a click away if additional support is needed.

“Don’t lose hope there is always a solution. Don’t try to take it all on yourself, we have the capabilities and the expertise, just get in contact with us and discuss your situation and see how we can assist. We already have a great track record of attainment and of being discreet and professional, let us help you too. We can take some of the burden for you. We are not here to judge, and we certainly don’t lecture. We offer salvation and are on your side.”

Karen Bain

Operations Manager – Ditch Debit with Dignity

Find out more about Ditch Debt with Dignity and access their interactive video resource at

ditchdebtwithdignity.com